In the dynamic realm of real estate, the allure of a super-low 3% mortgage rate can be enticing, offering short-term stability and affordability. However, a deeper exploration reveals a potential long-term pitfall known as the "Locked-In Effect."

Here's the issue

As our clients navigate a high-interest rate environment, they find themselves hesitant to sell or move, fearing a significant increase in their house payment. This phenomenon has led many to stay in their "starter homes" or the home they started their family in, missing out on the wealth-building opportunities inherent in trading up to larger family homes.

But what if the larger, bigger "family home" as it sometimes called represents the biggest opportunity to build equity and wealth?

The locked-in effect arises from the reluctance of homeowners to part with their 3% mortgage rates, fearing the prospect of doubling or tripling their house payments in a high-interest rate environment.

The Trade-Up Home Advantage

The larger, trade-up home represents a significant opportunity to build equity and wealth. While the current 3% mortgage rate offers financial stability, it may hinder the realization of long-term financial goals. The most opportunity for wealth is getting into that larger home and using that starter home to buy your next home. Opting for a larger family home enables homeowners to harness the equity in their starter homes, paving the way for substantial wealth accumulation. As we reflect back in 30 years, the exponential growth in equity in the trade-up home will far surpass that of the starter home.

The Positive Outlook Amidst Falling Interest Rates

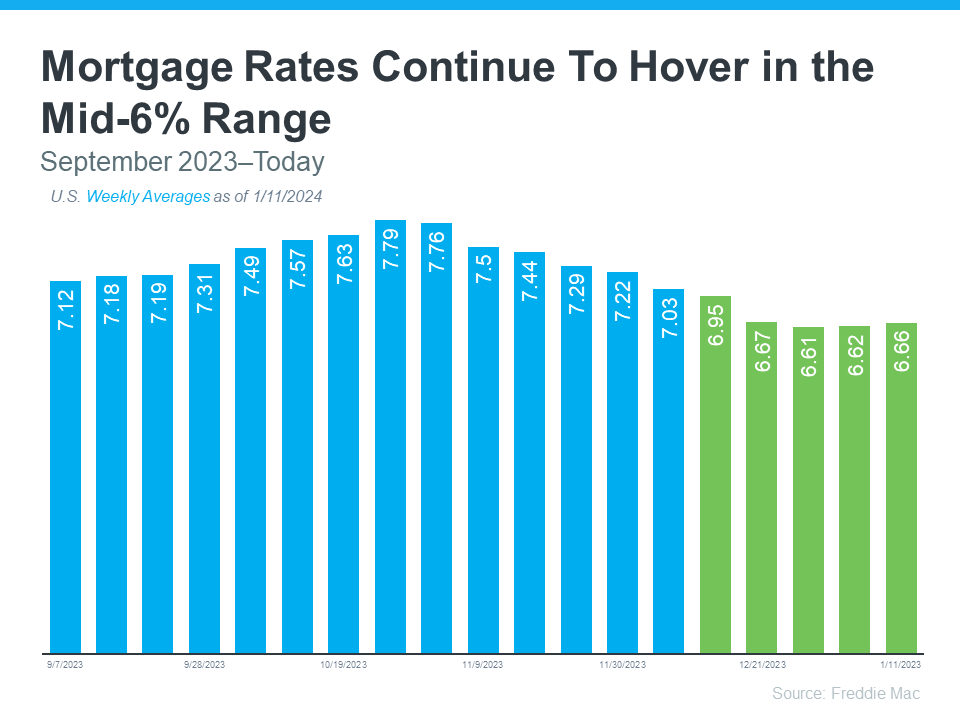

Amidst the challenges posed by the locked-in effect, there is a silver lining in the form of falling interest rates. As rates continue to trend downward, homeowners may find themselves less bound to their current mortgage rates. The decreasing difference between existing and potential rates makes moving more affordable, encouraging individuals to explore the possibilities of trading up to larger homes.

Lance Lambert, Founder of ResiClub, suggests that we might be at the peak of the "lock-in effect," signaling an opportune moment for move-up or lifestyle sellers to reconsider their positions. The expectation of interest rates going down further adds to the optimism, providing homeowners with the chance to break free from the perceived constraints of their current mortgage rates.

Sellers: More Buyers Entering the Market

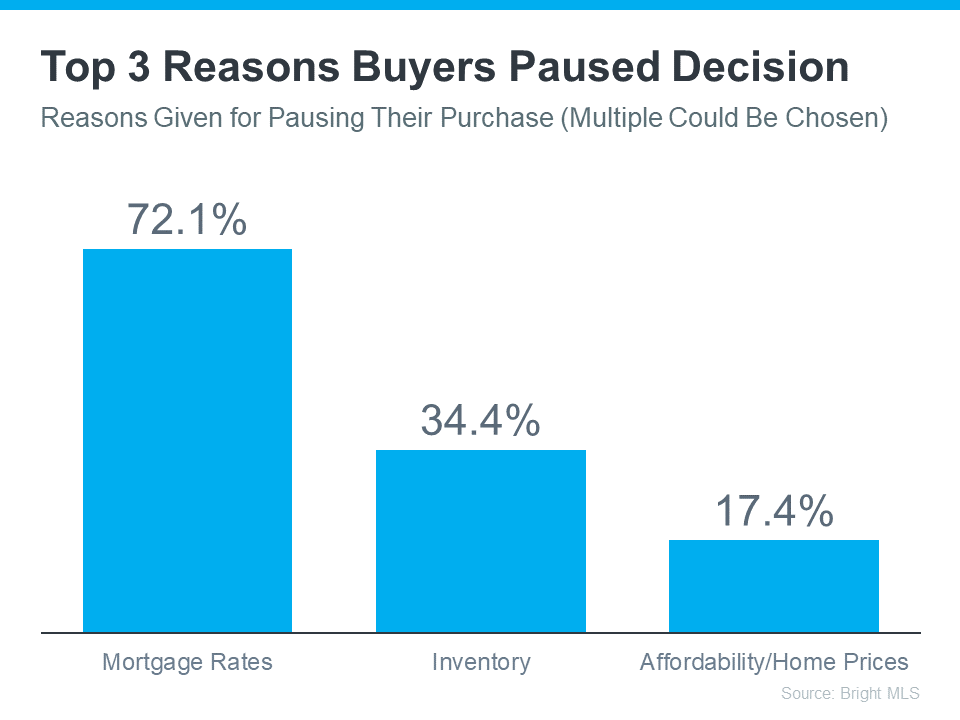

Data from Bright MLS indicates that high mortgage rates have been a significant deterrent for potential homebuyers.

However, the easing of mortgage rates presents an opportunity for more buyers to enter the market. Lower rates translate to potential savings on home loans, making homeownership more attractive and affordable. As rates continue to ease, the influx of buyers is likely to create increased demand in the housing market.

However, the easing of mortgage rates presents an opportunity for more buyers to enter the market. Lower rates translate to potential savings on home loans, making homeownership more attractive and affordable. As rates continue to ease, the influx of buyers is likely to create increased demand in the housing market.

Navigating the Future of Real Estate

In conclusion, the interplay between low mortgage rates, the locked-in effect, and the prospect of falling interest rates shapes the landscape of real estate. Homeowners are urged to consider the long-term implications of remaining in a home with super-low mortgage rates and maybe always looking for that next home could be the right option for you. Embracing the potential of falling interest rates opens avenues for trade-up opportunities, providing a pathway to larger, more valuable homes and greater wealth accumulation.

Seize the moment when rates decline – envision your home paid off in 30

years. Consider the choice: the largest, most valuable home with

substantial equity or the starter home you compromised for over the

years. Every situation is unique, and we're delighted to engage in a

discussion to determine the best fit for your family.